How the Supreme Court’s Student Debt Ruling Effects LGBTQ+, Black Americans

Author: Trudy Ring

While much of the LGBTQ+ community’s attention is focused on the Supreme Court’s 303 Creative decision today — and rightly so — the court’s decision striking down President Joe Biden’s student debt forgiveness program is concerning as well.

In its decision for Biden v. Nebraska, the court ruled 6-3, in a conservative-liberal split, that Biden and Secretary of Education Miguel Cardona did not have the authority to enact the debt forgiveness measure, which would have canceled $430 million in student debt. The court said authority to establish such a program lies with Congress, although the Biden administration argued that it had the power under an existing law, the HEROES Act.

The ruling “means that 20 million borrowers who were eligible to have their loan balances completely erased will soon have to start making payments,” The Washington Postnotes.

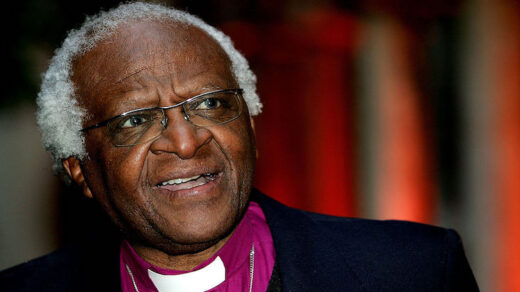

The ruling will disproportionately affect LGBTQ+ and Black Americans — and those with multiple marginalized identities, David Johns, executive director of the National Black Justice Coalition, tells The Advocate.

“Hundreds of thousands will be negatively affected by this,” he says.

The NBJC cites various studies that show LGBTQ+ and Black Americans having a greater student debt load than their straight and white counterparts.

LGBTQ+ adults are more likely to have federal student loans than non-LGBTQ+ ones — 35.4 percent versus 23.2 percent, according to a 2021 report from the Williams Institute, a think tank at the University of California, Los Angeles, School of Law.

Other research notes that Black Americans have more than $25,000 more in student debt than white ones, and that 20 years after starting college, the median debt of white borrowers has been reduced by 94 percent, while Black borrowers still owe 95 percent. This is due in part to the persistent wealth gap between the races.

The Supreme Court’s ruling ignores the growing cost of higher education, which is crucial to unlocking employment opportunities and increasing earnings, Johns says. And debt forgiveness can also help people achieve dreams that don’t involve a pay raise.

Johns points out that he was able to pursue a career in government and activism due to a previous student loan forgiveness program. This enabled him to cope with taking a pay cut when he segued from teaching in the public schools to working as a senior adviser to the U.S. Senate Committee on Health, Education, Labor, and Pensions before he joined the NBJC.

Johns called on Congress and the president to take steps to address the student debt crisis, such as cancellation of interest, increased investment in historically Black colleges and universities, and other targeted relief programs.

He further urged action to reform the Supreme Court, although his organization hasn’t taken a stand on, for instance, expanding the number of justices. The Biden administration should do whatever it thinks appropriate to effect change at the court, he said. This includes helping to move along the many stalled nominations to lower federal courts, from which Supreme Court justices are often drawn. Given recent negative decisions on LGBTQ+ rights, affirmative action, reproductive freedom, and more, this is the time to act, Johns said.

The National LGBTQ Task Force is also speaking out on the student debt decision.

“The student loan case is a queer issue because education costs are more acute for middle- to low-income people in this country,” the Task Force tells The Advocate via email. “That’s especially true for queer students who may not have help from families. Economic injustice hits queer people and especially trans people the hardest. The student loan case decision is yet another setback for our communities who have been historically excluded and marginalized in this country.”

The Point Foundation, which offers scholarships to support LGBTQ+ college students in paying for their education, said that student debt is intimately tied to LGBTQ+ lives.

“Student debt is an LGBTQ issue. LGBTQ students disproportionately incur greater debt than their straight, cisgender peers,” the executive director and CEO of Point Foundation, Jorge Valencia, said in a statement. “Students and graduates are in critical need of the financial reprieve proposed by the Biden Administration’s plan, so today’s ruling takes away the hope of relief for students already saddled with an unequal share of the debt burden. This decision hamstrings our country’s capacity to fight for equity because it hinders LGBTQ students from pursuing their academic and professional goals. It slows our nation’s future leaders from bringing this country into the future.”

From Your Site Articles

Original Article on The Advocate

Author: Trudy Ring